Converting a population with a low financial literacy into customers of (digital) financial services

The Myanmar finance & banking industry is quite unique:

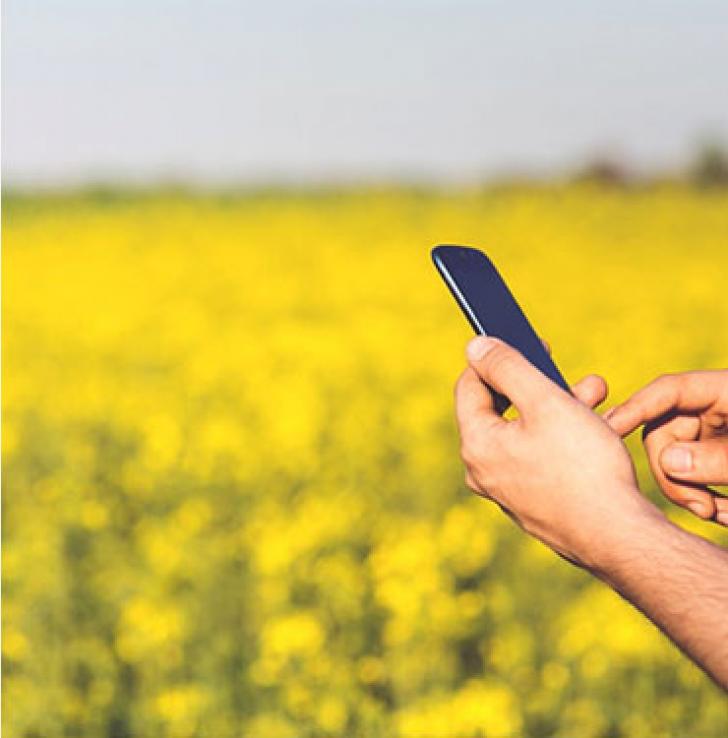

- Imagine a nation that was used to stockpile their cash at home as most had no access to banks or other formal financial services. ATMs were only rolled out mid 2012 and international credit cards launched in 2016, when major mobile money companies started to offer their services, too.

- Imagine a banking industry that is highly regulated by the government and is suddenly faced with the many challenges of digitalizing their operations, following international banking regulations and becoming customer-centric.

- Imagine a highly restricted insurance industry that is only allowed to offer a limited product portfolio - that is exactly the same across companies. While international insurers watch the market in waiting hoping to be allowed to enter in 2019.

We have researched people’s financial habits, needs, and fears since 2013. Furthermore, we have helped digital financial service companies fine tuning their approach by conducting Consumer Segmentation studies and research into their marketing mix appeal.

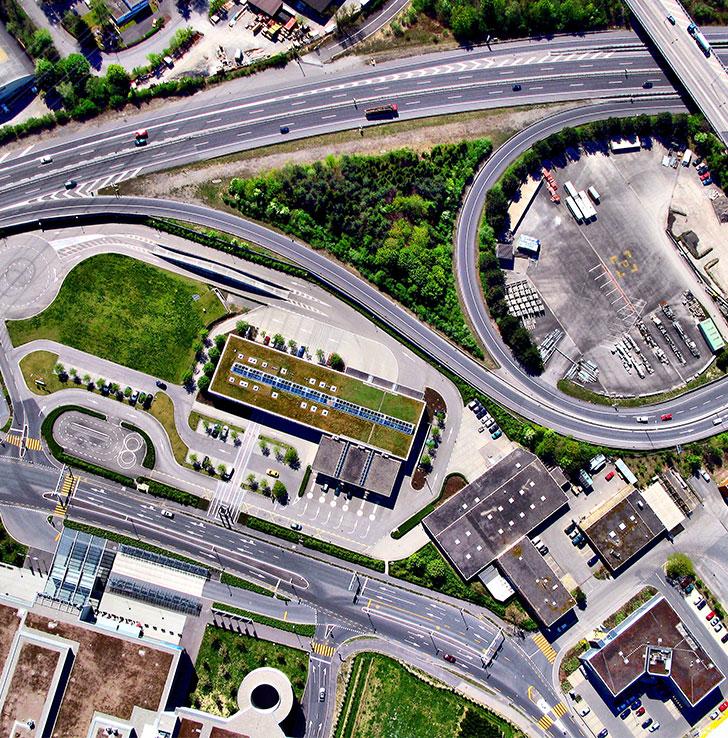

The big industry challenges are to increase the access to financial services, increase the financial literacy and trust-building to overcome usage barriers. For data on financial access please check out https://finmark.org.za/_country/myanmar/

We have interviewed banking and insurance employees, Financial Experts as well as CEOs and other Representatives from most banks in Myanmar to assess the Needs of the Industry. http://www.giz-banking-report-myanmar-2018.com/

MSR has helped a major local insurance company preparing to face foreign competition once the market will be liberalized and foreign competition allowed to enter in 2019.